Tesla has never been an ordinary stock. From its volatile price movements to its devoted investor base, TSLA often sits at the center of market conversations. Whenever the possibility of a Tesla stock split appears, investors immediately start asking important questions. Is this a buying opportunity? Does a stock split signal confidence or hype? And most importantly, is now the right time to invest in Tesla? Understanding the mechanics, motivations, and long-term implications of a TSLA stock split helps investors make informed decisions instead of emotional ones.

Quick Overview of the TSLA Stock Split

A TSLA stock split increases the number of Tesla shares available while reducing the price per share proportionally. The total value of an investor’s holdings remains the same, but the stock becomes more accessible. Tesla has used stock splits before, mainly when its share price rose significantly. These moves attracted attention from retail investors and increased trading activity, making the stock more liquid without altering Tesla’s underlying business value.

Understanding How a Tesla Stock Split Works

A stock split divides existing shares into multiple new shares. For example, in a 5-for-1 split, each shareholder receives five shares for every one share owned. The price adjusts accordingly. Tesla’s market capitalization, earnings, and fundamentals remain unchanged. What changes is the share structure, which often makes the stock appear more affordable to new investors and increases daily trading volume.

Why Tesla May Consider Another Stock Split

Tesla may consider another stock split if its share price rises to levels that feel inaccessible to many investors. While fractional shares exist, many retail investors still prefer owning whole shares. A split also helps Tesla maintain high visibility in financial news and keeps investor engagement strong. For a growth-focused company like Tesla, accessibility and perception play an important role in market participation.

Key Objectives Behind Tesla’s Stock Split Decision

The main objectives behind a Tesla stock split include improving liquidity, broadening investor participation, and maintaining positive market sentiment. Tesla does not use stock splits to fix weak fundamentals. Instead, splits usually follow periods of strong performance. They serve as a structural adjustment that aligns the share price with Tesla’s growing investor base rather than a tool to artificially boost value.

Impact of TSLA Stock Split on Investors

For investors, a TSLA stock split can feel exciting, but its real impact depends on strategy. Long-term investors see little immediate financial change, while short-term traders may benefit from increased volatility. Splits often encourage higher trading activity, which can lead to short-term price swings. Investors who understand this dynamic avoid emotional reactions and focus on fundamentals.

Accessibility and Liquidity After the Stock Split

After a stock split, Tesla shares become easier to trade due to lower per-share prices. This improved accessibility often leads to increased liquidity, meaning shares trade more frequently with tighter bid-ask spreads. Higher liquidity benefits both retail and institutional investors by making entries and exits smoother, especially during periods of market volatility.

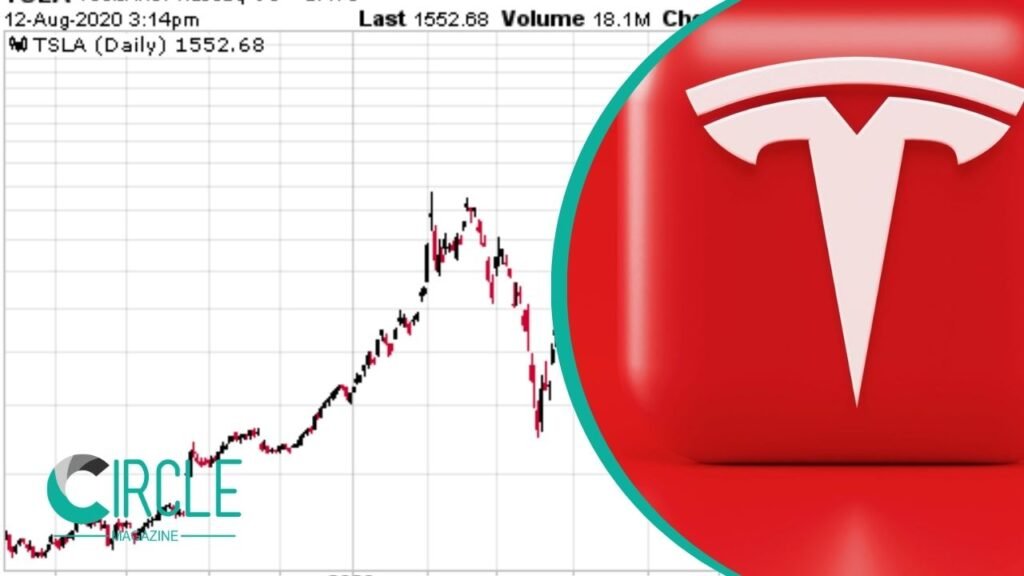

Market Reaction to Previous Tesla Stock Splits

Historically, Tesla’s stock experienced strong interest after previous splits. Trading volume increased, and investor enthusiasm followed. However, broader market conditions also influenced performance. While Tesla benefited from bullish momentum after earlier splits, those gains coincided with strong earnings growth and favorable macroeconomic trends, not just the split itself.

Short-Term vs Long-Term Effects of a TSLA Stock Split

In the short term, a TSLA stock split often increases volatility and media attention. Traders may attempt to capitalize on price movements driven by sentiment. In the long term, the split itself fades into the background, and Tesla’s fundamentals take center stage again. Revenue growth, margins, innovation, and execution ultimately determine long-term returns.

Is TSLA Stock Split Beneficial for Long-Term Investors?

For long-term investors, a stock split is generally neutral to slightly positive. It improves liquidity and attracts new investors, which can support demand over time. However, it does not change Tesla’s competitive position or growth potential. Long-term investors benefit most when they focus on Tesla’s business model rather than split-related hype.

How Retail and Institutional Investors Respond

Retail investors often react enthusiastically to stock splits because of perceived affordability. Institutional investors, on the other hand, focus more on fundamentals and valuation. While both groups increase activity after a split, institutions typically adjust positions based on earnings forecasts and macroeconomic factors rather than the split itself.

Psychological Impact of Stock Splits on Investor Behavior

Stock splits influence investor psychology more than financial reality. Lower share prices feel cheaper, even when valuation metrics remain unchanged. This psychological bias can drive increased demand and short-term rallies. Investors who recognize this effect can avoid chasing momentum and make more rational decisions.

Market Perception and Trading Volume Changes

A TSLA stock split often improves market perception by keeping Tesla in headlines and analyst discussions. Increased visibility leads to higher trading volume, which can amplify price movements. While this attention benefits liquidity, it can also increase volatility, especially when expectations rise faster than fundamentals.

Comparing Tesla’s Stock Split With Other Tech Giants

Tesla is not alone in using stock splits. Companies like Apple, Amazon, and Google have also split their stocks after significant price appreciation. These companies aimed to improve accessibility and maintain investor interest. Tesla’s approach aligns with this broader trend among high-growth technology leaders.

Lessons From Stock Splits by Apple, Amazon, and Google

Stock splits by major tech companies show that splits often follow strong performance rather than cause it. Apple and Amazon continued growing because of innovation and execution, not because of their share count. Tesla faces the same reality. Sustainable growth depends on business performance, not stock structure.

Risks, Valuation Concerns, and Common Misconceptions

One major misconception is that stock splits create value. They do not. Tesla’s valuation remains a key risk, especially during periods of rising interest rates or slowing growth. Investors who ignore valuation metrics may overpay, even after a split, and face downside risk during corrections.

Mistakes Investors Make Around TSLA Stock Splits

Common mistakes include buying solely due to split excitement, ignoring broader market conditions, and overtrading during volatile periods. Some investors also assume past post-split gains guarantee future performance. Avoiding these mistakes requires discipline and a long-term mindset.

Regulatory, Governance, and Technical Considerations

Stock splits require board approval and follow regulatory guidelines. Tesla must ensure compliance with exchange rules and shareholder communication standards. While these considerations rarely affect investors directly, they ensure transparency and fairness in the process.

Could Tesla Announce Another Stock Split in the Future?

Tesla could announce another stock split if its share price rises significantly again. However, timing depends on market conditions, valuation, and strategic priorities. Investors should treat potential splits as structural adjustments rather than investment signals.

Final Thoughts: Is This the Right Time to Invest in TSLA?

The right time to invest in TSLA depends on your goals, risk tolerance, and belief in Tesla’s long-term vision. A stock split can improve accessibility and liquidity, but it does not change Tesla’s core value. Investors who focus on fundamentals rather than headlines position themselves for better long-term outcomes.

Frequently Asked Questions (FAQs)

What is the TSLA stock split?

A TSLA stock split increases the number of Tesla shares while reducing the price per share proportionally.

How many times has Tesla split its stock?

Tesla has split its stock multiple times, most notably in 2020 and 2022.

Does a stock split change Tesla’s real value?

No, it does not affect market capitalization or business fundamentals.

Is a TSLA stock split good for long-term investors?

It can improve liquidity, but long-term returns depend on Tesla’s performance.

Should investors buy Tesla shares before or after a split?

Timing matters less than strategy. Long-term investors often use dollar-cost averaging.

Can Tesla split its stock again in the future?

Yes, if the share price rises significantly and management sees value in doing so.

VISIT MORE : Circle Magazine

2 Comments

Pingback: Los Angeles Rams vs Seattle Seahawks Match Player Stats Explained - Circle Magazine

Pingback: The Future of Online Investing With 5StarsStocks.com - Circle Magazine